Explain the Different Methods of Calculating Cost of Equity Capital

The Cost of Equity for XYZ Co. CAPM formula shows the return of a security is equal to the risk-free return plus a risk premium based on the.

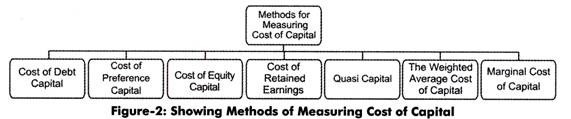

7 Methods For Measuring Cost Of Capital

Under this variant Cost of Equity can be calculated as.

. WACC provides us a formula to calculate the cost of capital. Weighted Average Cost of Capital. Cost of Retained Earnings.

Cost of Equity Dividends per share Current market price of stock. Explain how to estimate the cost of capital. Method 1 Cost of Equity Formula for Dividend Companies.

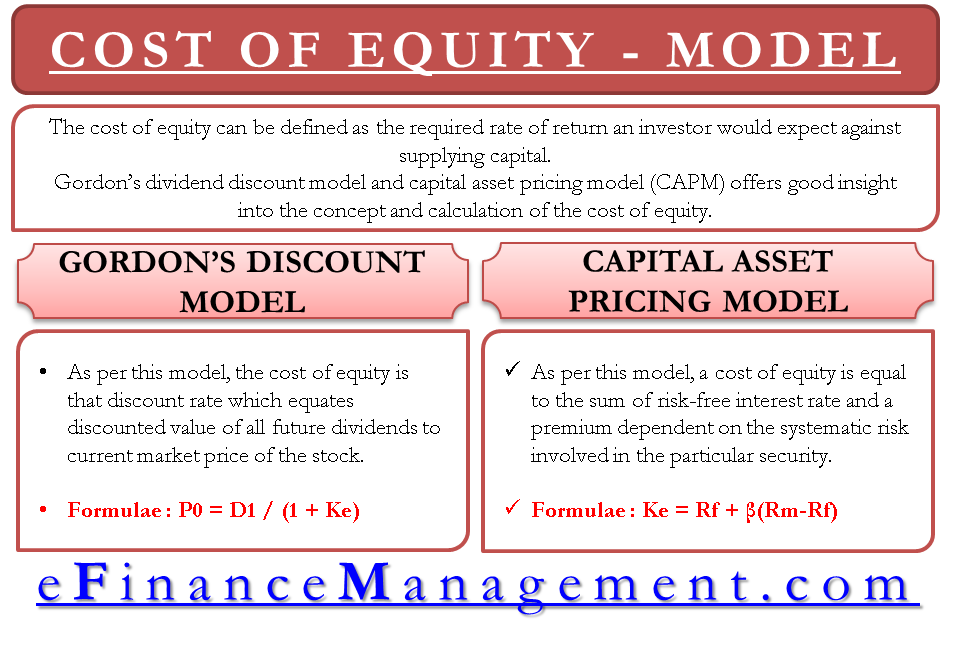

Marginal Cost of Capital. In general an equitys risk premium will be between 5 and 7. These are the capital asset pricing model the dividend discount model and the bond yield plus risk premium method.

The computation of overall cost of capital involves the following steps. The equity risk premium is essentially the return that stocks are expected to receive in excess of the risk-free interest rate. The formula for this is as follows-Cost of equity share Earning per share Market Price per share 4 Realised yield.

4512left 9-45righttext 99 45 12 9 45 99. The normal historical equity risk premium for all equities has been just over 6. Cost of equity is calculated with dividend yield method or dividend yield plus growth rate method or earning yield method or realised yield method.

Ii Assign proper weights to specific costs. The formula for calculating the cost of. According to dividend price approach we can calculate cost of capital just dividing dividend per share with market value of per share.

The application of the Capital Asset Pricing Model CAPM to compute the cost of equity is based on the following relationship. 2 9 4. Cost of Equity Capital.

R f risk-free rate of return R m market rate of return beginaligned CAPMtextCost of equity R_f betaR_m -. Cost of equity Dividend per share of next yearcurrent market value of stock Growth rate of dividend As per Capital asset pricing model. The weighted average cost of capital is the combined cost of each component of funds employed by the firm.

In their opinion a firm can minimise the weighted average cost of capital and increase the value of the firm by using debt financing. Three methods are used to estimate the cost of equity. A firm raises capital from different sources such as equity preference debentures etc.

Cost of retained earnings. Its value shows what amount we are giving per. Cost of Debt Capital.

Cost of Equity Risk Free Rate Equity Risk Premium. Cost of Preference Capital. Methods of Calculating Cost of Equity Capital.

Cost of Equity formula can be calculated through below two methods. Cost of preference shares. D Proportion of debt capital in capital structure.

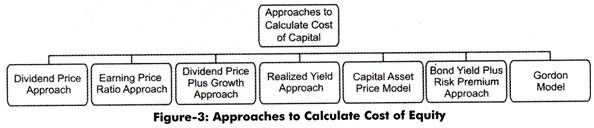

The banks get their compensation in the form of interest on their capital. Cost of Equity Rf βRm-Rf Here is the cost of equity is the risk-free rate is the expected return for the market portfolio and is beta. There are three methods commonly used to calculate cost of equity.

K D 1-050 10 100 5. This cost shows direct relationship between price of equity shares and price of dividend. Assuming 50 corporate tax rate calculate weighted average cost of capital on existing capital structure.

The cost of equity can be calculated by using the CAPM Capital Asset Pricing Model Capital Asset Pricing Model CAPM The Capital Asset Pricing Model CAPM is a model that describes the relationship between expected return and risk of a security. Common methods for estimating the equity risk premium include. Cost of equity capital when growth rate is given DMP G 100.

Numerous online calculators can determine the CAPM cost of. Computation of Overall Cost of Capital. P Proportion of preference capital in capital structure.

The cost of debt in. Paid a dividend of 20 for many years and expects to continue paying dividends at the same level in the future while the current market price of its stock is 150. The solution is given as follows.

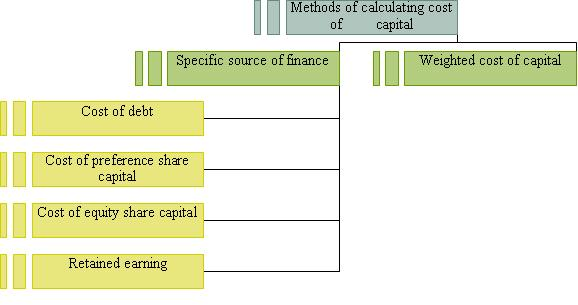

Computing specific cost of capital involves summing up of all forms of capital listed below. Weighted Average Cost of Capital. In particular explain how to estimate the equity cost of capital list two different methods to estimate the debt cost of capital and how to calculate the weighted average cost of capital for a given debt-equity ratio.

K E 10100 10 100 10. Specific Cost refers to the cost which is associated with the source of capital. The cost of debt capital is the cost of using a banks or financial institutions money in the business.

Method 2 Cost of Equity Formula using CAPM Model CAPM Model The Capital Asset Pricing. Computation of Composite Cost of Capital. I Dividend yield method - Under this method company can calculate cost of equity on the basis of following formula.

Cost of equity - CAPM. For example lets assume a company XYZ Co. Iii Multiply the cost of each of the sources by the appropriate weight.

The capital asset pricing model CAPM the dividend discount mode DDM and bond yield plus risk premium approach. Your answer to this question should not be more than 2 page. The most common approach to calculating the cost of capital is to use the Weighted Average Cost of Capital WACC.

C A P M Cost of equity R f β R m R f where. Cost of debt after tax 1 T R 100. Specific cost of capital is the cost of equity share capital cost of preference share capital cost of debentures etc individually.

Capital Asset Pricing Model. Weighted Average Cost of Capital KE x E KP x P KD x D Kr x R Where E Proportion of equity capital in capital structure. In the capital asset pricing model cost of equity can be calculated as follows.

Composite capital is the combined cost. Beta represents a systematic risk in the equation. Systematic risk is that risk that is not avoidable by diversification.

Cost of equity shares. The formula for Cost of Equity Capital Risk-Free Rate Beta Market Risk Premium Risk-Free Rate Cost of Debt. Cost of equity Cost of equity is the Rate of return that stake holders require from investment in a company.

According to the Net Income Approach and the traditional theories both the cost of capital as well the value of the firm have a direct relationship with the method and level of financing. I Compute specific cost for each individual projects. Under this method all sources of financing are included in the calculation and each source is given a weight relative to its proportion in the companys capital structure.

To calculate this formula is as follows-Cost of equity share Dividend per equityMarket Price Rate of growth in dividends 3 Earning yield method In this cost of equity capital is minimum and the earning of the company should be considered on market price of share. KR Cost of proportion of retained earnings in capital structure.

7 Methods For Measuring Cost Of Capital

Computation Or Methods Of Calculating Cost Of Capital Management Education

Belum ada Komentar untuk "Explain the Different Methods of Calculating Cost of Equity Capital"

Posting Komentar